We now have a 3 step Budgeting course showing you how to get started!

Our original thought was that people would read the book and work through it to learn the system. But we have found that not everyone enjoys reading self-help budgeting books as much as I do!

Someone recently asked, “How do I get started?” and we didn’t have a great answer other than, go read the book. So I came up with 3 short, to the point videos to get you going before you read the book.

There is a lot more capability to our system than what I show in these videos. There’s a lot more to the emotional and psychological reasons for why it works so well. But if you just want to get the basics down quickly, this is for you!

Step 1 – The Concept

The first step is understanding HOW our system is different than a typical budget.

This is a really big mental shift! It’s OK if you don’t completely get it at first. Going through the next step will help because you are going to use your own numbers and see the magic of it all at work.

Step 2 – The Spreadsheet

Download the spreadsheet here. We’re going to walk you through how to fill it out in the most simple way possible.

Now you have your income and fixed expenses projected out. A weekly allowance that works for your situation. And a cool cash flow chart showing what your future looks like day by day! Now you just have to track your spending so that you don’t go over your weekly allowance!

Of course there are more tweaks and things that you can add in later. Email us at Hello@HappyGiraffe.org if you want us to walk you through anything you have questions about.

Step 3 – Tracking

Now you need a way to make sure that, as you go through your week, you have a way to know how much you have spent and how much of your weekly allowance you have left.

This is a different purpose for tracking than you might be used to. You aren’t tracking your money to create a categorized record of your past. We don’t care what you spent on eating out 3 months ago. As long as you don’t go over your weekly allowance, the category doesn’t matter. The only goal of tracking your spending is to make sure you don’t go over the allowance you have each week.

You can do this however you want. We like to use a free app called GoodBudget. This shows you how to set it up to work with our system.

That’s all you need to know to get started! You’ve got a spreadsheet that organizes all of your finances in one place, shows you what your future will look like, and helps you find a weekly allowance that works for your situation. You’ve also got a way to track to that weekly allowance so you always know what you have left!

Bonus!

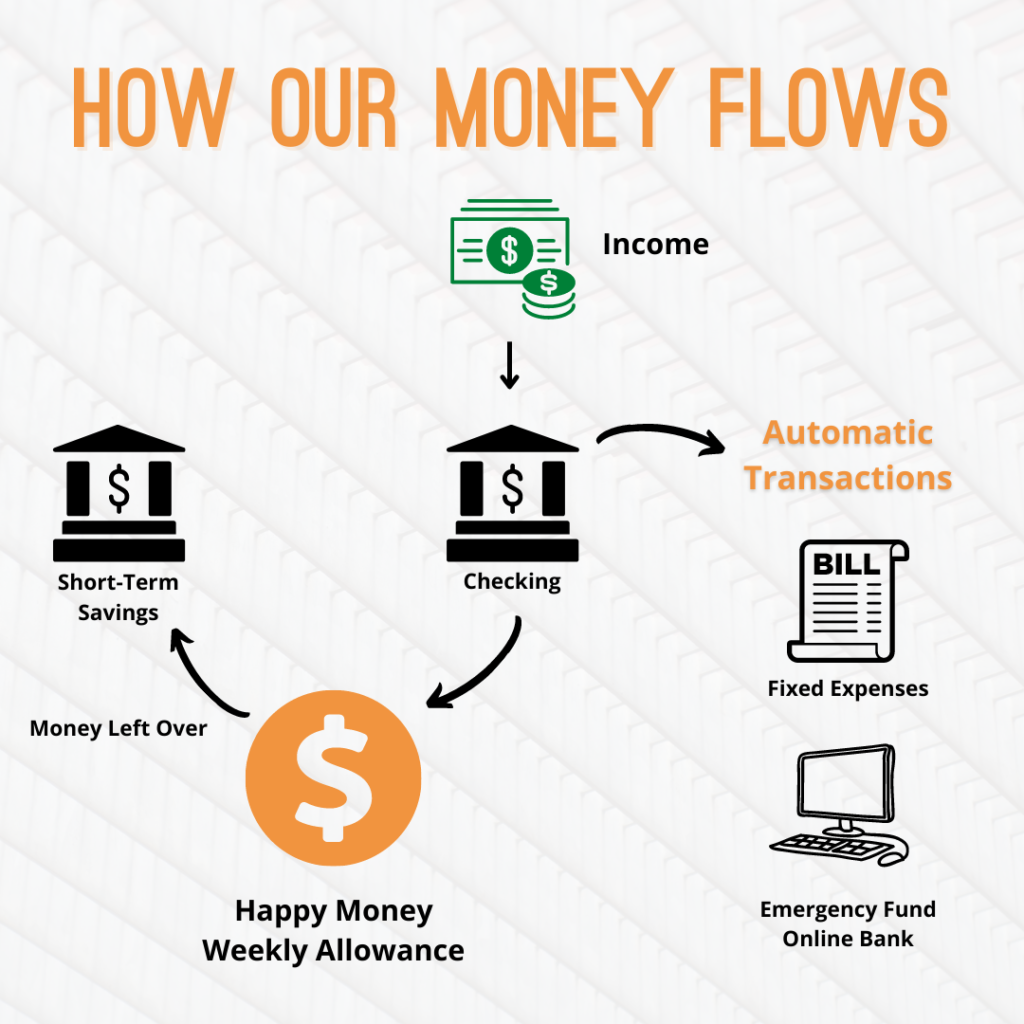

Just as an added bonus it is helpful to see how your money flows between real life accounts. It isn’t that complicated. All of our income goes to one checking account. All of our bills are set up on auto pay and come from the checking account. We also put money into an online account for our emergency fund. We spend our weekly allowance. Anything left over at the end of the week goes into short-term savings, which is a savings account at the same bank.

Hopefully that helps get you started! If you have any questions or need help at any point just email us at Hello@HappyGiraffe.org. We are always happy to help and it doesn’t cost anything to ask us questions.