We have a new debt payoff planner and tracking spreadsheet! Download it here! We know a lot of people who are interested in budgeting are also trying to get out of debt. It can be confusing to know where to start. Also, because it often takes a long time to get out of debt, it’s hard to stay motivated through the process. Our Free Budgeting app also helps you stay on track!

Why We Made It

I’ve looked through a lot of free online excel spreadsheets designed to help you create a debt payoff plan and track your progress. Most focused on just one part, creating the plan, or tracking. For people who love Excel, it’s exciting to create the plan, with every detail imaginable, down to the penny. But in real life, it’s not possible to follow that plan perfectly. So the plan is helpful to give you hope and to get you started, but you need more than that. You need something that’s flexible and keeps you motivated when things change.

I found some good tracking spreadsheets, but they weren’t tied to a plan. It felt like you had to go to one place to get some direction (often with way too much detail for the average person), and then go to another place to write down how you are doing month by month (again with too many details and things that are exciting for an Excel nerd, but not needed by most people). So I created one for The Happy Giraffe so I could combine the two sides and simplify things down to what you need to see if you aren’t an Excel techie.

(I personally use Excel every day and love the extra financial details. But I think most people just want help getting out of debt and Excel is a necessary thing they have to deal with to make that happen. I assume they want the experience to be as simple and quick as possible. I get that. That’s why my wife helped me make the original budget spreadsheet and this one too. She still thinks a pivot table is a physical table that pivots somehow!)

So with that background in mind, I’m excited to show you what we have and I hope it helps you on your debt free journey.

How to use it

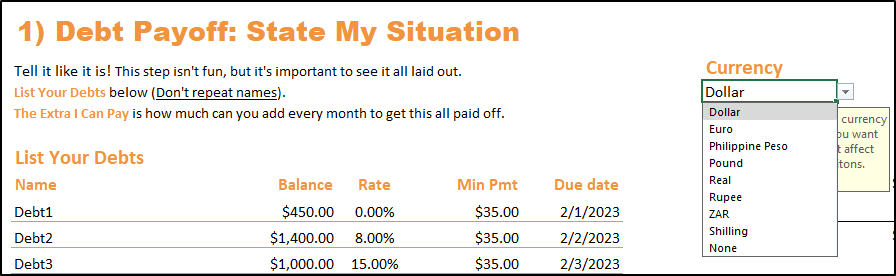

The spreadsheet can handle up to 20 debts. (If you need more than that, email us. We can go up to 70 but the spreadsheet gets really slow with that many!) Enter in a name, the current balance due, the rate, and the next due date. You’ll also need to enter how much you can pay on top of the minimum payments.

Choose a plan and see the steps

For the plan you can decide to use either the avalanche method (focusing all your money on paying the debt with the highest interest rate first. This one is usually the best option financially, but can be harder to stick to because it may take a while to get the first debt paid off.) Or the snowball method (focusing all your money on paying the debt with the lowest balance first. This one is usually the best option emotionally, because you get some quick wins paying off the smaller balances which is exciting).

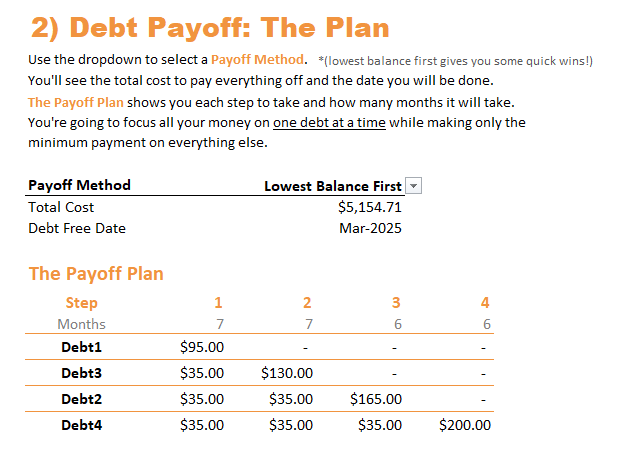

Instead of showing every detail of the estimated plan’s payments (you can still see them in the “nerdy details” tab), we show you the basic steps you need to take. The spreadsheet will say, “Start by focusing all your extra money on this debt. It’ll take about this many months to get it paid off. Then focus all your money on this next debt. It’ll take about this long to get paid off.” And on down the line until you are debt free.

In this example you would start by paying $95 a month on Debt1 while making minimum payments on the others. Do that for 7 months and you’ll have Debt 1 paid off. Then roll all of the money into paying off Debt 3 while making minimum payments on the rest. Do that for another 7 months and Debt3 will be done with!

Track your progress

Once you know the basic steps, you’ll spend most of your time on the tracking sheet. Here you can decide what to do, follow the plan exactly, do your own thing, pay more than expected one time, or pay less than expected another time. It’s up to you and your circumstances. Each time you enter in a payment you’ll see the progress you’re making for each individual debt and you’ll also see the progress for your total debt. The spreadsheet will update your expected debt free date and you can see if you are beating your original plan. This helps keep you motivated and you can easily see the progress you are making until you make that final payment.

Is It really free? What’s the catch?

We get this question a lot! There’s no catch.

It doesn’t feel right to charge people when they are having a hard time and doing their best to get their finances under control. So we created a non-profit, volunteer our time, and made everything free on or website.

(Our book is the only thing we charge for because we haven’t figured out how to make that free. It’s a great book, but it isn’t required to learn or use anything we have.)

Because of the decision to make everything free, donations are important! If you like what we do, and you are in a place to afford a small donation, please support us!

I really hope this is helpful and simplifies things down to what really matters to help you reach your goals. I’m happy to help anyone fill it out or answer questions. You can also reach out just to let us know if you are using it. We’re putting this out there for free because people need it. It shouldn’t be expensive to get help paying off your debt and to learn how to budget. Download the spreadsheet here! or Get the Free Budgeting app here!

Leave a Reply