*Updated Again May 1st, 2023!

One of our users found an issue with copying and pasting in the fixed expenses tab that is now fixed.

Updates based on your suggestions

We have been hard at working making some updates to our budgeting spreadsheet based on your suggestions and feedback! Thank you to so many people who have given us ideas and taken the time to email us. It has been great to hear from you and see things through your perspective.

To get the most recent version click here. The file name should include a date of “2023-5-1” (year, month, day) or later.

Also, everything is built in Microsoft Excel. I know it can work in other Excel type programs like Numbers or Google Sheets, but I haven’t tested it in those. You can get an online version of Excel completely free. I wrote a blog about how to get it here.

We will make updates videos for the spreadsheet soon showing how to use it and what it can do.

The changes!

I did a lot of work on the formulas that do everything behind the scenes. I simplified and reorganized things so it should run faster and be easier to follow if there is an issue I need to troubleshoot. You won’t see all that work, but I wanted to let you know that we are improving things and testing them out. We are also grateful to those of you who have helped find any issues our spreadsheet has had.

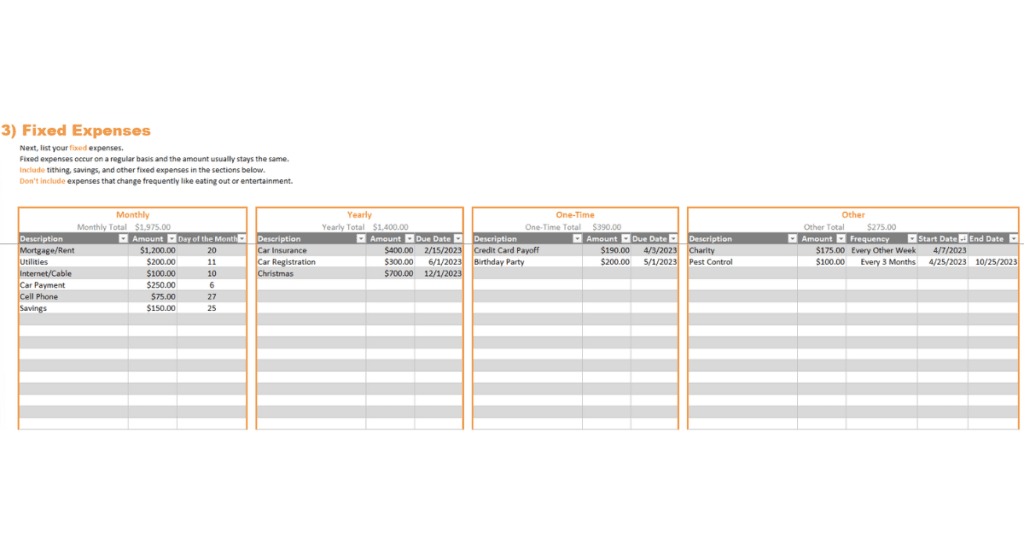

The only place you will see any changes in on the “Fixed Expenses” tab. It used to show columns for weekly, monthly, yearly, and one-time expenses.

Now you will see monthly, yearly, one-time, and other. We removed weekly because most people don’t have weekly fixed expenses. It was the least used and least helpful of the sections. It also led to confusion about what a fixed expense was. People coming from other budgeting systems would want to put a lot of things in the weekly section when they should really all be rolled into the Happy Money or weekly allowance on the next tab. We want to have less categories. A weekly section just made it too easy to keep categories that didn’t really need to be there.

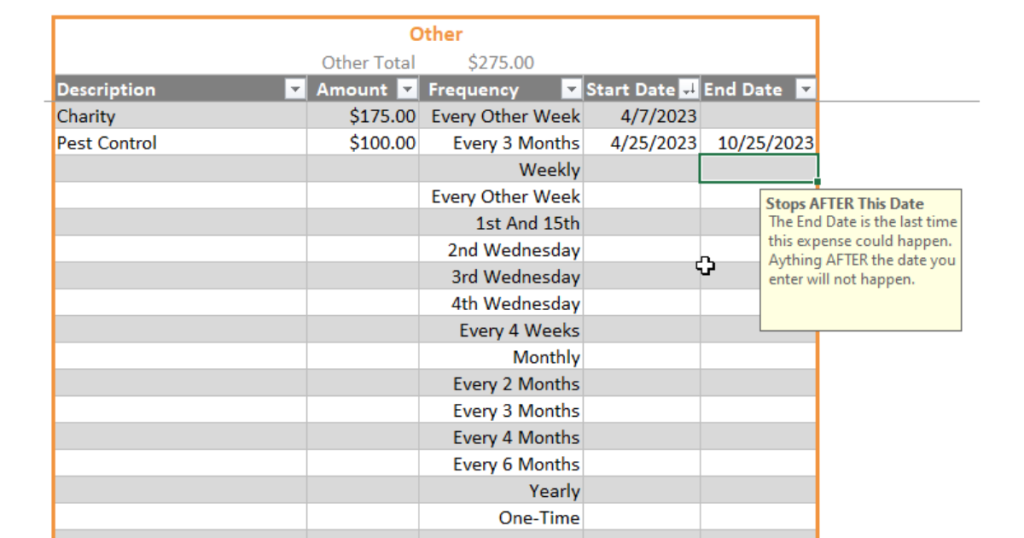

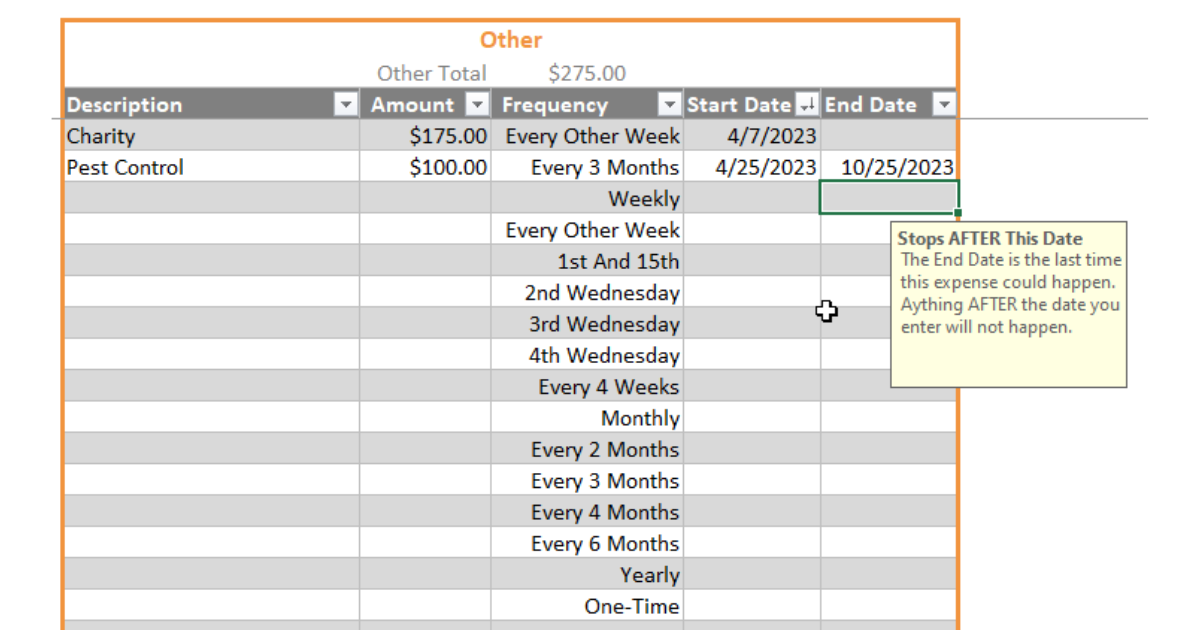

The “Other” section has some cool new features!

Now you can choose from a long list of frequency and timing options! You can also set the start and end dates for each one.

All of the options for income timing show up in this list as well. So if you get paid every other week, you can have an expense come out every other week and line up with your paycheck. That’s something that was hard to do before, but it is easy now!

The Amount, Frequency, and Start Date are all required in order for things to work correctly. Without an amount or frequency, the spreadsheet won’t know what to do, so it just won’t do anything. If there is no start date it will default to 1/1/1900 as the start date (fun fact, that was a Monday). That’s probably not what you want. So make sure you put something in there.

We also added end dates! They are not required, but they can be helpful. If you have a subscription or service or credit card payment that you know will end on a certain date, you can now enter that in here. This is also a feature many people have wanted so we added it in.

In the example above, I am paying for pest control every 3 months (this is the same as quarterly, or 4 times a year). But I know right now that the last time I am going to pay for their service is on 10/25/2023. I’m going to pay for that October bill and then I am definitely cancelling. So now I can put that in and the spreadsheet will calculate everything knowing that those payments are going to be done.

Power and Caution!

If you want to, you could put everything in the other section. That is totally fine. You can sort it to group it by frequency or amount or whatever you like to make it easier to see. This is a really powerful new section!

The caution comes with trying to predict every detail to perfection and then trying to track day to day expecting it to match. This wasn’t built to do that. You can’t know every detail 2 years ahead of time and it isn’t important to know them.

This was built with the intent to give you a really good estimate of your fixed income and expenses with the goal to help you find a weekly allowance (your Happy Money) that will work for your financial situation.

Once you find the weekly number that works for you, set your bills on auto pay, start using something like the Godbudget app to track to that weekly amount, and don’t even look at this spreadsheet again for 6 months!

Unless something changes with your income or fixed expenses, you don’t need to check your day to day finances against this spreadsheet. Definitely track your Happy Money often! But quit looking at the spreadsheet. It did it’s job. You don’t have to worry about it anymore.

I know that is a hard transition to make. But you will be happier when you do. With our system, you can stop worrying about your bills and stop checking how much is in your bank account. All you worry about is living to your Happy Money each week. We are simplifying in a responsible way. You handled the hard things at the right time and in the right way when you filled out the spreadsheet. Now let go of all the categories and bills and balances. Day to day, you don’t need to worry about them anymore. Your worrying isn’t helping them or you. Just track to your Happy Money. One simple number. One week. That’s all that matters.

Leave a Reply