There are many budgeting methods out there. The Happy Giraffe Budget is the newest (and I obviously think it is the best), but it is interesting to see what other methods exist and how they are similar or different from each other. We’re going to cover:

The “What’s In The Bank” Method

This one has been around a long time and might be the first one you used yourself. It’s not really a budget at all. There’s no forward looking or planning involved. There’s no tracking either. You can even use it without a bank account.

The only concern is, “How much money do I have right now?” That’s it. You live life on the edge. It’s the ultimate paycheck to paycheck lifestyle. There’s some idea that bills are due in the future. But the decision on if you are good to buy something or not is mostly based on if you have the money in the moment.

While this may sound carefree at first, it makes life and dealing with money really hard and scary. Every day is a surprise! That is really stressful because you are constantly feeling like you don’t know what tomorrow will bring. It’s even worse once you add credit cards to the situation. They make it look like you always have enough. Until you hit the card’s limit.

Just like with bills, there’s a feeling that consequences are out there, but you don’t know what they are or when they will hit. Ignorance is bliss for a short time, but it is really just covering up the stress and fear that something bad is just around the corner.

The Zero Based Budgeting Method

This is what most of us think of when we think of budgeting. Almost every actual budget of any kind is really just this method being marketed with a different name. Whether you use a ledger with pen and paper, some fancy app like Mint, Dave Ramsey’s ideas, or some internet guru’s idea, it’s all the same.

You write out your income for the next month on one side, then on the other side you make a detailed plan for how you are going to spend that money. It is always based on a monthly concept and the goal is to spend every penny, but not more. The income side is usually fairly easy to figure out. The expenses side can be incredibly detailed with 30, or even 50 or more, categories that you should consider. Once your income and expenses are equal for the month you are done and you have your budget ready.

This method has some big issues, the most important being that it just doesn’t work for most people. It’s a wonderfully detailed and perfect budget from an accountant’s point of view. But real life is much messier and unpredictable. They will all blame your lack of determination when the method fails for you, but if something isn’t working for that many people, is it really YOUR fault?

The Envelope Method

This is another way to do zero based budgeting, but I mention it because a lot of people have heard of it and try it out at some point. This is where you take all of the categories you created and decided on in your monthly zero based budget, and you put the cash for each one into an envelope. This is supposed to help you see how much money you have in each category (because it is physically there in the envelope) and stop you from spending more than that.

This can be a helpful approach for some people. It makes the money and the limits you made tangible and real. I’ve used this method myself. I can remember the little box we had with cash in each envelope.

The problem here is that it is still just a zero based budget, but with slightly more visible limits. I know you aren’t supposed to steal from other envelopes when you get to the end of the month, but in reality most of us do. I’m not going without food for the last week of the month just because I spent too much in the first week of the month.

You are still plagued with the same basic issue. You can’t predict everything that will happen, in every category you come up with, a month ahead of time. Life is messy. In the corporate world, where a zero based budget works well, there are governance boards and approvals needed if you want to over spend. They have accounting and finance people with full-time careers making sure money is moved from one bucket to another and telling some people “No” when the cash isn’t there.

Your personal life is a lot less predictable and you don’t have the same setup as a corporation. It’s just you, and possibly a spouse, with little financial training at all. Again, they’re going to blame you and your lack of discipline when you fail, but still is it really YOUR fault, or is the method at least partly to blame?

The 50/30/20 Rule

This isn’t really a budget as much as it is a way to make yourself feel bad. The idea is to look at your spending and try to get to a point where 50% of your money goes to needs, 30% to wants, and 20% to savings. The numbers are completely arbitrary, but they are supposed to help you see if you are spending “too much” in some areas vs others.

You can decide to judge yourself like this no matter what budgeting method you use. You can use it to judge your past spending or use it to make your goals for future spending. Obviously, I don’t love it. But it’s an idea that can be used with any other budgeting method. Just don’t beat yourself up too much. You aren’t a failure if you can’t get your “need” spending down to 50% of your income.

Pay Yourself First

Again, not a real budget. I’m mentioning it because you will see it when you do a google search for budgeting methods. It’s a nice idea that I am not against. It just says that when you get paid, put money into savings or pay off debt before you do anything else. You can do this with any real budgeting method.

It isn’t a bad idea. I hope it is part of whatever method you choose. But it is just an idea to keep in mind, not a method for how to budget.

Weekly Budgeting

Usually when you see this one, it is the same as the monthly zero based budget, but you divide the amounts into weeks. It’s another example of how almost every method you find (that is an actual budgeting method) is really just a twist on the zero based method.

As you will see later, I love the idea of a weekly budget. You don’t run out of money so quickly at the beginning of the month. It is a lot easier to stop spending when you run out of money in a category. Weeks are naturally easier to live to and understand.

The problem with the way most methods do this is that the zero based method is still at it’s heart. Months don’t divide easily into weeks. There are still tons of categories to worry about. Sometimes dividing a category into weeks can result in comically small budgets. It takes a lot of work to track and manage everything.

The Paycheck Budgeting Method

This is the first method that is concerned with your cash flow and isn’t just a small twist on the monthly zero based budget. The idea is that you know when you are going to get paid, so you need to match up your expenses with the timing of your income. This is a nice idea. It’s a step in the right direction. It’s also helpful for people who want to visually see how everything is going to work out.

The downside is that it takes a lot of planning, time, and (most likely) some paper and different colored markers. It’s also focused mostly on your bills, so you are left on your own to figure out how to handle the messy daily stuff that comes up.

You’ll need to print out a calendar showing the next few months. You add your expected income to the calendar on the days you plan to get it. Then you add your bills and their due dates to the calendar and keep a running total of how much you have left from each paycheck after that bill is paid. (You’ll probably want to color code all of this). Then you add in other expenses you know of on the dates you plan to pay them.

This leaves you with a visual of how much money you will have on any given day. It is nice because it shows you the flow of cash you have available and makes it easy to see if something isn’t going to work out. This is pretty unique from other budgets we have mentioned so far. It’s a good step forward. It just takes a lot of work to do and misses everything that isn’t a bill or easily predictable.

YNAB (You Need A Budget)

When this came out, it was the most innovating thing that had happened in the budgeting space. It is an actual budgeting method. It isn’t just a small twist on the zero based method. It helps you look forward and plan more than one month ahead. It is visual. There’s a lot to like about YNAB.

You use their app and enter your expected income. Then you enter your known expenses. Then you divide what is left over into the other categories you want to track. It is a lot like the paycheck budgeting method, but it is all online and you are able to look at every category you want to. The goal is to spend less than you earn. So much so that they would like you to get to a point where you are living on money you earned 30 days ago or more.

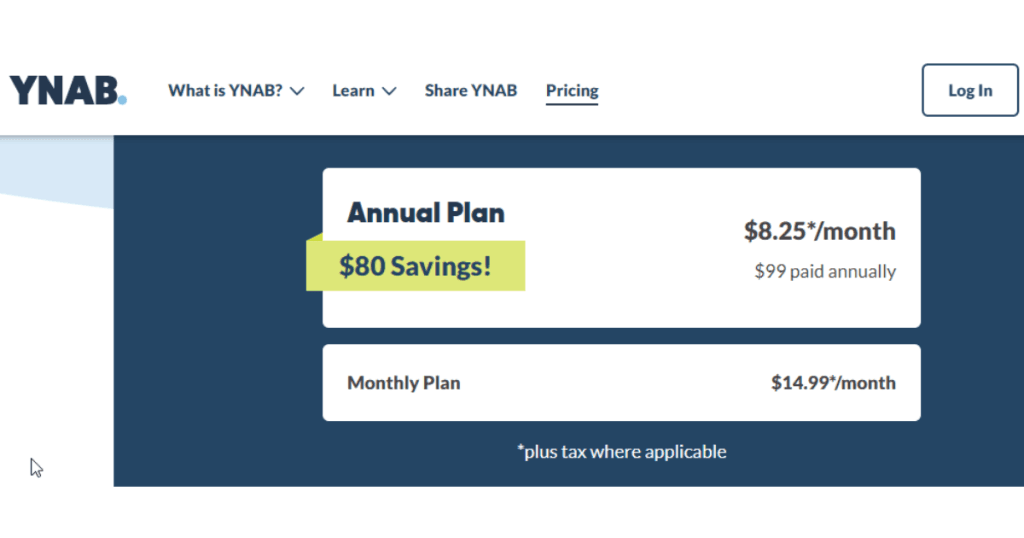

The difficulties with the system come from the fact that it is so different than other budgeting methods. It is very detailed and there is a significant learning curve to figure it all out. Even when you do figure it out, there are a lot of pieces to keep track of. It still encourages you to create a lot of categories and assumes you can predict those and track to them with every purchase. It also costs a monthly fee to use their website.

I tried this one more than once because I wanted it to work for me. But there was just too much detail in it and I couldn’t get over the learning curve before I would get frustrated and give up. I know it has helped a lot of people and I love that they bring something truly innovative and new to the budgeting world.

The Happy Giraffe Budget

This is the newest and most innovative thing to happen to budgeting so far. I know I am biased. It’s not just a small twist on the zero based method. It is an actual method and not just a nice idea. It is visual. It considers your cash flow. It looks forward a full two years into the future. It is much easier to learn and use than YNAB. It overcomes the issue most budgets have with assuming you can predict everything ahead of time.

You can read all of the details in our book here, but here is the basic idea. You download our free spreadsheet here. Enter your income. Enter your FIXED expenses (bills and things like that). Then divide what is left into weeks. That becomes your weekly allowance (or Happy Money as we like to call it). The spreadsheet will do all of the hard work so you can see the money coming in and going out each day.

There are a lot of benefits to this:

- It is super simple. You don’t have a ton of categories to track. You have one target to hit each week, your Happy Money. That gets rid of all the complexity and data entry that are involved in other systems, but don’t really add value.

- The learning curve is quick. It is definitely different, but it is easy to understand and do.

- It shows your cash flow day by day. This is a big deal that many methods miss. In real life the timing of money coming in and going out is important. It also does this without you having to get out a calendar and map it all out yourself.

- You don’t have to predict the future. You can change how you spend your money every week if you want to. It’s flexible enough to handle the craziness of life. You don’t have to have it all planned out a month ahead of time. You can handle it in the moment instead.

- You don’t have to recreate your whole budget every month. With most systems you spend a lot of time each month categorizing and planning for what that next month will look like. With this method, you do it one time and then you just live to your Happy Money each week.

I’ve used this method for over 10 years and it has worked well in many different income and life circumstances. I think it would work well for just about anyone at any time of life.

If you want to learn more about the details of why it works so well you can buy our book here on Amazon. If you just want to try it out, we have a short 3 step course with video tutorials to help you.

There are a lot of budgeting methods out there. I hope you find one that works well for you. I think The Happy Giraffe Budget is unique and innovative in many ways. It is worth your time to try it out if some of the other methods haven’t worked for you. (It’s free because we are a nonprofit and the book is only $15 if you want to read it. If you have kindle unlimited then the book is free too!)

Leave a Reply